Best Crypto Brokers: A US Trader's Guide

Choosing the right platform to buy, sell, and trade cryptocurrency is one of the most critical decisions for any investor in the digital asset space. While many are familiar with crypto exchanges, the term "crypto broker" is also prevalent, representing a distinct and important part of the ecosystem. This guide is designed to demystify the world of crypto brokers for US users, clarify how they differ from exchanges, and rank the best platforms for 2025, with a special focus on why hybrid models like OKX are becoming the preferred choice for many.

Crypto Broker vs. Exchange: What's the Key Difference?

Understanding the distinction between a broker and an exchange is crucial to selecting the right platform for your needs. While the lines have blurred in recent years, the fundamental difference lies in how you trade.

The Role of a Broker: Simplicity and Access

Traditionally, a crypto broker acts as an intermediary, using a large network of exchanges and liquidity providers to find the best price for your trade. When you place an order with a broker, they execute it on your behalf. This model is often simpler for beginners, offering a straightforward interface that resembles a traditional stock brokerage. The price you see is typically inclusive of a "spread," which is the broker's fee.

The Role of an Exchange: Liquidity and Direct Trading

A crypto exchange is a marketplace that directly connects buyers and sellers. It facilitates peer-to-peer trading through an order book, where users can set their own prices (e.g., limit orders). Exchanges create liquidity by bringing a large volume of traders together. This model is preferred by active traders who want more control and access to advanced tools like charting and various order types. Fees are typically charged as a small percentage of the trade value (maker/taker fees).

The Modern Hybrid Model: Platforms like OKX

Today, many leading platforms, including OKX, operate as a hybrid broker-exchange. They offer both a simple "Buy/Sell" interface that functions like a broker (offering a quoted price) and an advanced trading platform that functions as a direct exchange with an order book. This model provides the best of both worlds: beginners can enjoy simplicity, while experienced traders can access deep liquidity and powerful tools, all within a single ecosystem.

How We Ranked the Best Crypto Brokers

Our evaluation process focuses on the factors most important to US-based traders and investors.

- Regulation and Security: We prioritize platforms that adhere to US regulatory standards and employ robust security measures, such as cold storage of assets and two-factor authentication (2FA).

- Fees, Spreads, and Pricing Transparency: We look for platforms with competitive and transparent fee structures, whether they are based on spreads, commissions, or a combination.

- Trading Platform and Tools: The quality of the trading interface, availability of charting tools, mobile app functionality, and order types are key considerations.

- Asset Variety and Support: The range of available cryptocurrencies and the quality of customer support are also critical.

Top 5 Crypto Brokerage Platforms in the US

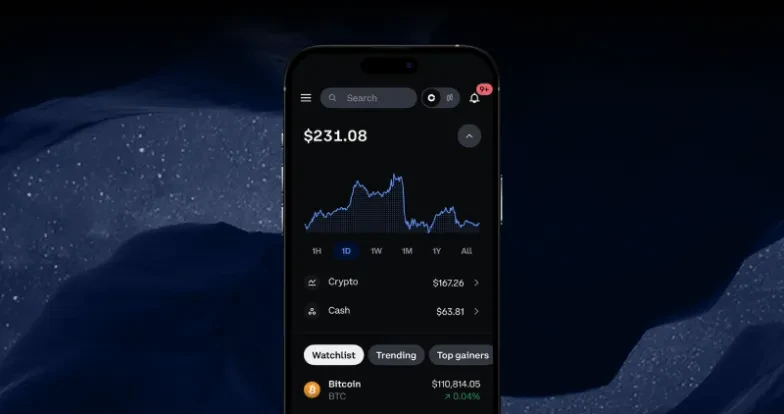

OKX: Best Hybrid Broker-Exchange for Low Fees and Advanced Tools OKX excels by offering a powerful hybrid model. Its simple "Buy Crypto" feature is perfect for beginners, while its advanced trading platform provides some of the lowest fees in the industry, deep liquidity, and a professional-grade suite of tools, making it ideal for both new and seasoned traders.

eToro: Best for Social and Copy Trading eToro stands out with its unique social trading features, allowing users to follow and copy the trades of experienced investors. It's a great platform for those who want to learn from others and engage with a community, though its spreads can be higher than competitors.

Coinbase: Best for Ease of Use and Insured Custody Coinbase offers a highly intuitive brokerage service that makes buying crypto incredibly simple. It's a trusted, publicly-traded company in the US with a strong focus on security and ease of use, making it a popular entry point for beginners.

Kraken: Excellent for Advanced Traders and Margin While primarily an exchange, Kraken's platform is a top choice for serious traders who need access to advanced features, including margin trading and futures. It's one of the oldest and most respected platforms, known for its strong security.

Robinhood Crypto: Simple, No-Commission Trading Robinhood offers a straightforward, commission-free way to buy and sell a selection of popular cryptocurrencies. While it lacks the advanced features of other platforms, its familiar interface makes it an easy transition for existing stock traders.

Understanding Brokerage Fees: Spreads vs. Commissions

How a broker charges you can significantly impact your returns.

- What is the Spread? The spread is the difference between the buying price (ask) and the selling price (bid) of an asset. Brokers that offer "commission-free" trading typically make money on this spread. The price you pay is slightly higher than the market price, and the price you sell at is slightly lower.

- Commission-Based Fees: This is the model used by exchanges and some brokers. A transparent percentage-based fee is charged on each trade. Platforms like OKX use a maker-taker fee model, which incentivizes traders to provide liquidity.

Are Crypto Brokers Safe? A Look at Regulation and Security

In the US, the regulatory landscape for crypto is evolving. Reputable brokers and exchanges serving US customers comply with FinCEN regulations and employ strict Know Your Customer (KYC) and Anti-Money Laundering (AML) policies. When choosing a broker, look for one that is transparent about its security practices, such as how it stores user assets (predominantly in cold storage) and whether it undergoes third-party security audits.

Frequently Asked Questions (FAQ)

Q1: Is my money safe with a crypto broker? Reputable crypto brokers use advanced security measures, including cold storage and 2FA, to protect user assets. However, no platform is entirely risk-free. It's crucial to use a trusted provider and enable all available security features.

Q2: Which crypto broker is best for a beginner? For beginners, platforms with simple user interfaces like Coinbase or the "Lite" mode on the OKX app are excellent choices. eToro is also great for those who want to learn through copy trading.

Q3: Is OKX considered a broker? OKX operates as a hybrid platform. It offers a simple brokerage-like service for easy buying and selling, as well as a full-featured exchange for advanced trading, providing a comprehensive solution for all user levels.

Q4: Can I use leverage with a crypto broker? Some advanced crypto platforms, like Kraken and OKX, offer margin and futures trading, which involves leverage. These products are complex and carry high risk, so they are suitable only for experienced traders.

Q5: What are the tax implications of using a crypto broker? In the US, cryptocurrencies are treated as property for tax purposes. You must report capital gains and losses from your trading activity. Most reputable brokers provide users with tax forms (like 1099-B) to simplify this process.

Conclusion

The line between crypto brokers and exchanges is increasingly blurred, with hybrid platforms like OKX offering a comprehensive solution that caters to everyone from first-time buyers to professional traders. When choosing the best crypto broker, US users should prioritize security, regulatory standing, transparent fees, and a platform that aligns with their trading experience and goals. By doing your research and selecting a reputable provider, you can navigate the exciting world of crypto with confidence.

Disclaimer: This article is for informational purposes only and not financial advice. Trading cryptocurrency involves significant risk. Consult with a qualified professional before making investment decisions.

© 2025 OKX. This article may be reproduced or distributed in its entirety, or excerpts of 100 words or less of this article may be used, provided such use is non-commercial. Any reproduction or distribution of the entire article must also prominently state: “This article is © 2025 OKX and is used with permission.” Permitted excerpts must cite to the name of the article and include attribution, for example “Article Name, [author name if applicable], © 2025 OKX.” Some content may be generated or assisted by artificial intelligence (AI) tools. No derivative works or other uses of this article are permitted.